- +971 555878967

- kashif@ficfinco.com

VAT Return Filing Services In UAE

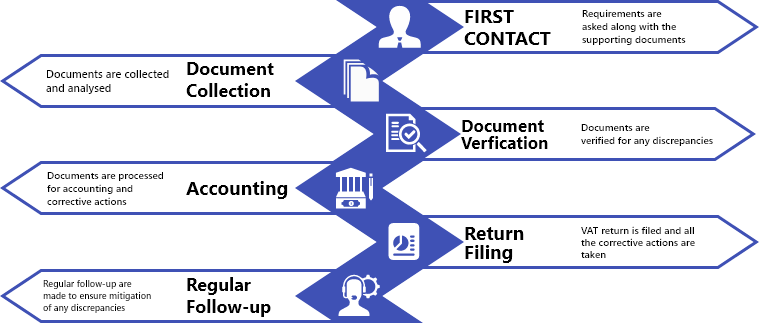

Calculation of VAT is a tiresome and dreary process as a compilation of entire taxable supplies and exports for the period has to be calculated. After subtraction of the net supplies and demand, VAT return has to be filed through the online portal of the Federal Tax Authority. It is done under the e-services by visiting eservices.tax.gov.ae by filling up the form for return filing, commonly known as Form VAT 201.

Most importantly, VAT is applicable likewise on tax-registered businesses managed in UAE mainland as well as free zones, although the exchange of goods between designated zones are deemed tax-free. UAE coordinates VAT implementation with the other GCC countries.

The VAT return filing of UAE is highly difficult for businesses that have little or no experience in filing the VAT, as it requires consolidated details of sales/ purchase. The details also need to feed in a specified format according to FTA, making it more complex. Therefore, it is wiser for all kinds of eligible businesses to go after VAT return filing services offered by popular vat consultancy such as NSKT Global due to various perks:

- Collating and compilation of all transactions for filing VAT in described format by FTA.

Development of summary and consolidated details of Sales/ Purchase, Output and Input VAT. - Reduction of chances of missing the deadline to zero, ensuring compliance at all times.

- Utilization of the latest taxation software for efficient tax filing.

- FTA approved tax agents/experts available to represent in front of the authority on behalf of clients as and when required.