- +971 555878967

- kashif@ficfinco.com

Forensic / Fraud Investigation Services In UAE

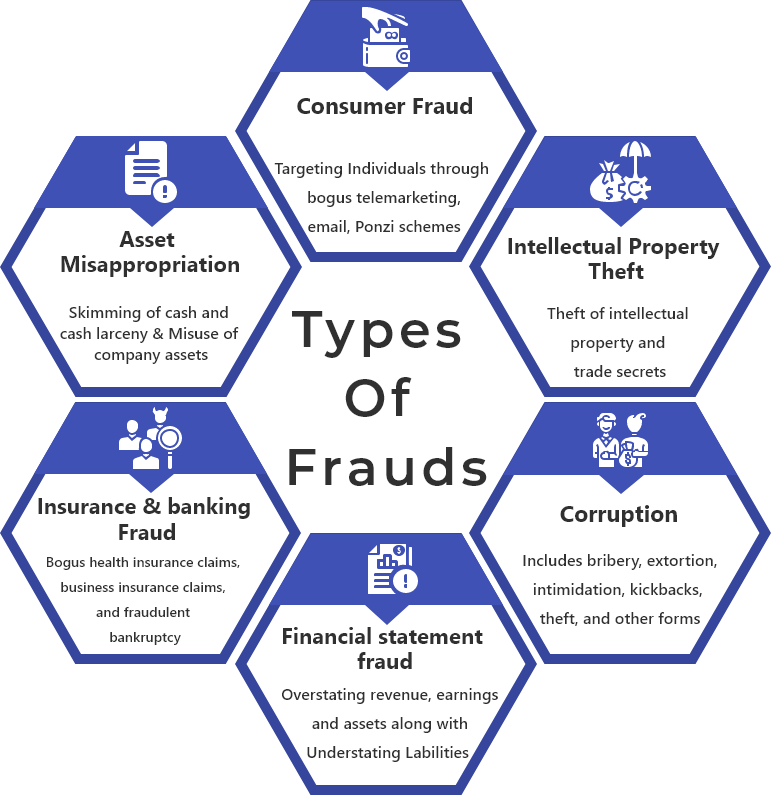

One of the most important aspects which have destroyed several brand images, while carrying out a Business audit, is the presence of fraud or criminal activity harboring inside an organization. Due to increasing volatility and competitiveness in business, some of the organizations diverge from the path of ethics and commit fraud or get involved in criminal activities or misconducts, money laundering, etc. Investing in organizations without carrying out proper forensic/ fraud investigation may invite immense damage to a brand’s reputation.

Fraud & Forensic Investigation Service

With fraud on the rise, it is crucial how your company adopts fraud risk control policies to keep pace with the changing and growing risk of fraud. It is very much important for a company to assess all kinds of frauds that come their way and deal with them efficiently. Due to increasing volatility and competitiveness in business, some of the organizations diverge from the path of ethics and commit fraud or get involved in criminal activities or misconducts, money laundering, etc. Investing in organizations without carrying out proper forensic/ fraud investigation may invite immense damage to a brand’s reputation.

Fraud Risk Assessment

Threats will affect the path to success of the business without proper prevention measures. Any corporation faces risks. Successful risk management will result in a better view of the essential organizational and business risks of your company. Depend on a partner with comprehensive expertise and vast knowledge to truly identify and handle the variety of risks the company poses. A thorough risk appraisal can allow organizations to consider which risks exist, how they could affect company processes, and how risk control based on the risk appetite of management should be prioritized. A risk evaluation includes:

- An evaluation of risks, mitigating controls, and the associated residual risk exposure to the company in a given business line or procedure.

- Enterprise-wide interviews with owners of systems, leadership, and related stakeholders.

- A high-level overview of the audit committee’s assessments, including the most important challenges facing the company, as well as guidance for how to manage such risks.