- +971 555878967

- kashif@ficfinco.com

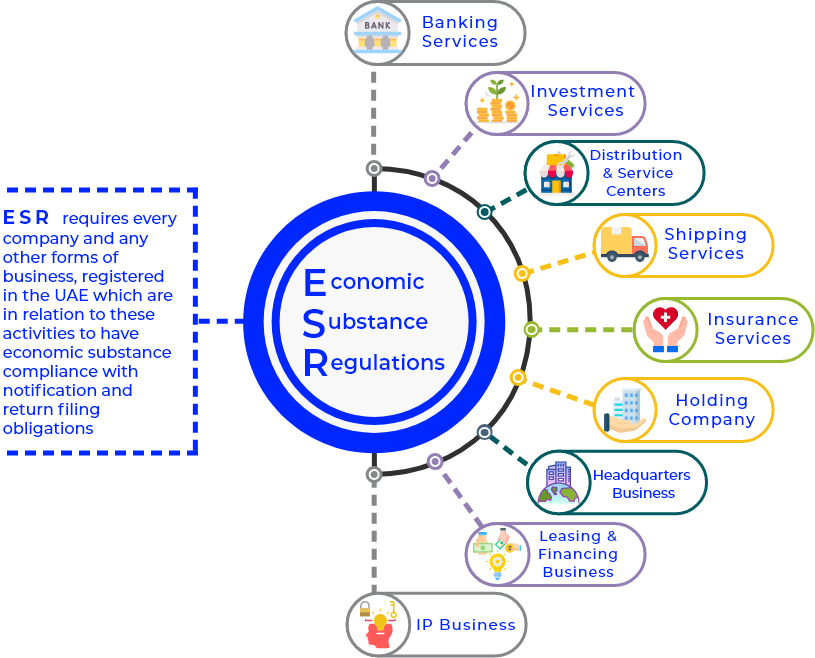

Economic Substance Regulations In UAE

Governments across the globe amend their laws periodically to address common issues such as money laundering, frauds, etc., or increase transparency in the current procedures, or welfare of the common folk. With the implementation of the UAE Economic Substance Regulations from Jan 1st, 2020, the UAE government has taken steps to ease and expedite tax transparency in the country along with fair tax competition.

These new laws are applicable to natural or legal persons, including all UAE offshore and free zone organizations, branches, non-profit organizations, and partnerships also referred to as licensees. As per the new regulation, every licensee in the UAE who is associated with any of the above-mentioned activities has to submit a notification to the respective regulatory body. Furthermore, the licensee has to satisfy an “economic substance test” and submit its report in every financial period to the respective regulatory authority.

An economic substance test is to be carried out for validation of the following facts:

- Licensee and their relevant activity is managed as well as directed in the UAE.

- Their relevant core income-generating activities are carried out in the UAE.

- Employees and physical assets, as well as expenditure, are in adequate number in the UAE.